The Most Popular Rent Estimate Searches on Rentometer in 2024

As 2024 comes to a close, we took the opportunity to reflect on what Rentometer users analyzed most in our rental pricing database over the past year. This year alone, Rentometer facilitated over 5 million rent estimate searches across all its platforms, showcasing the vast interest in understanding rental markets across the U.S.

Here’s a breakdown of the most popular searches completed by our users in 2024, categorized by building type, bedroom counts, and top-searched locations.

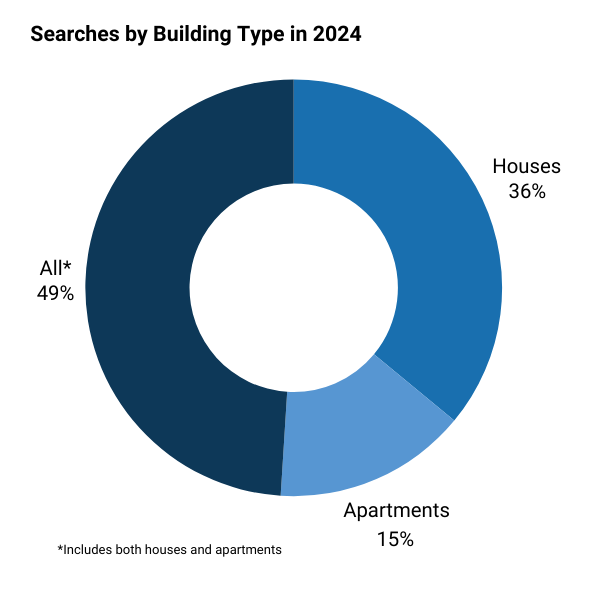

Searches by Building Type

In 2024, searches by building type revealed intriguing insights:

- 15% of total searches were for apartments.

- 36% of total searches were for single-family homes.

- 49% of total searches were for “All” which includes both apartments and houses.

Notably, 51% of searches specified a building type, and within this subset, there was a strong skewing toward single-family rentals (SFRs):

Stay connected

Get rental market insights delivered straight to your inbox.

- 29% of designated searches were for apartments.

- 71% of designated searches were for single-family homes.

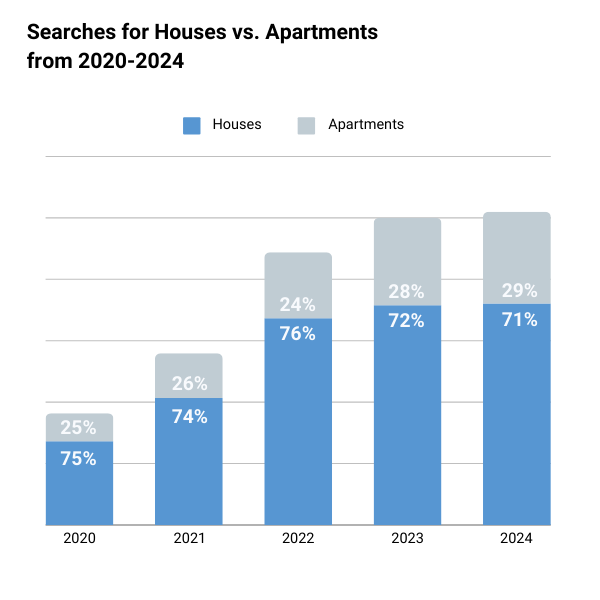

When compared to previous years (2020-2023), the average split was 25% apartments and 75% houses. However, the past two years have shown a slight shift, with searches for single-family homes decreasing and searches for apartments increasing.

Potential Factors Influencing This Shift

Several factors may explain the drop in searches for single-family homes:

- Limited Supply of Single-Family Homes

- The scarcity of single-family properties makes them harder to acquire for both homebuyers and investors. This limited availability has likely kept more people renting apartments.

- This trend is underscored by the National Association of Realtors’ recent report, which found that only 17% of potential first-time buyers (current renters) can afford to purchase a median-priced starter home. This is a significant decline from 37% in 2021 and 42% in 2019, reflecting how rising home prices and high mortgage rates are pricing out millions of potential buyers.

- Higher Interest Rates

- Elevated interest rates have made it more economical for investors to purchase multi-unit properties over single-unit properties, further driving interest in apartments.

These observations of searches on our website highlight a dynamic rental market where economic conditions and supply constraints are shaping demand for different property types.

Most Searched Bedroom Counts

Apartments by Bedroom Type

In 2024, Rentometer users searched for two-bedroom (2-BR) apartments more than any other bedroom count. These were followed by one-bedroom (1-BR) apartments and then three-bedroom (3-BR) apartments.

The popularity of 2-BR apartments may be attributed to their versatility:

- They’re ideal for small families, roommates, or individuals needing extra space for a home office.

- Many renters find the balance between cost and space most appealing in 2-BR units.

Houses by Bedroom Type

When it comes to single-family homes, the most searched bedroom configuration was three-bedroom (3-BR) houses, followed by two-bedroom (2-BR) and four-bedroom (4-BR) homes.

The popularity of 3-BR houses reflects their broad appeal, offering:

- Ample space for families, accommodating children and activities.

- A balance of affordability and comfort, making them a practical choice for many renters.

While single-family rental prices grew in Q3 2024, the rate of growth slowed compared to the previous quarter’s annual growth rate of 4.2%. This deceleration is largely due to sustained demand for rental housing in both suburban and urban areas, as:

- High mortgage rates continue to deter potential homebuyers.

- Rising home prices push many to remain in the rental market.

For a deeper dive into the 3-BR SFR market, explore Rentometer’s latest quarterly report. The next edition is set to release later in January.

Top 10 Most Popular Cities by Bedroom Count

We identified the top 10 cities that landlords and real estate professionals are most interested in for two-bedroom and three-bedroom rentals. This data provides valuable insights into market demand across various regions. Here are the cities that topped the search list:

2-Bedroom Rent Estimate Searches

3-Bedroom Rent Estimate Searches

Conclusion

As we prepare for 2025, these insights help us better understand the rental market dynamics and continue to provide valuable tools for both renters and property managers. Stay tuned for more reports and updates from Rentometer in the coming year!

Transform Data into Decisions with Rentometer

As the nation’s premier source for rent data, Rentometer empowers over 1.4 million real estate professionals each year with accurate, hyperlocal rent estimates and comps. Whether you’re optimizing rental income or scouting your next real estate opportunity, we provide the insights you need to move forward with confidence. Get started today!

Stay connected

Get rental market insights delivered straight to your inbox.

LinkedIn

LinkedIn

Facebook

Facebook

Email

Email

Twitter

Twitter

Quickly evaluate current rents with QuickView™ Rent Estimates

Quickly evaluate current rents with QuickView™ Rent Estimates