9 Proven Ways to Find Profitable Investment Properties

The best real estate investors know that great deals don’t just fall into your lap — they’re discovered through smart research, reliable data, and strategic sourcing. Between data-driven tools, traditional MLS platforms, and off-market opportunities, there’s no shortage of ways to uncover your next high-performing rental, multifamily, or fix-and-flip opportunity

Below are nine proven strategies — organized by how experienced investors actually find and evaluate opportunities today.

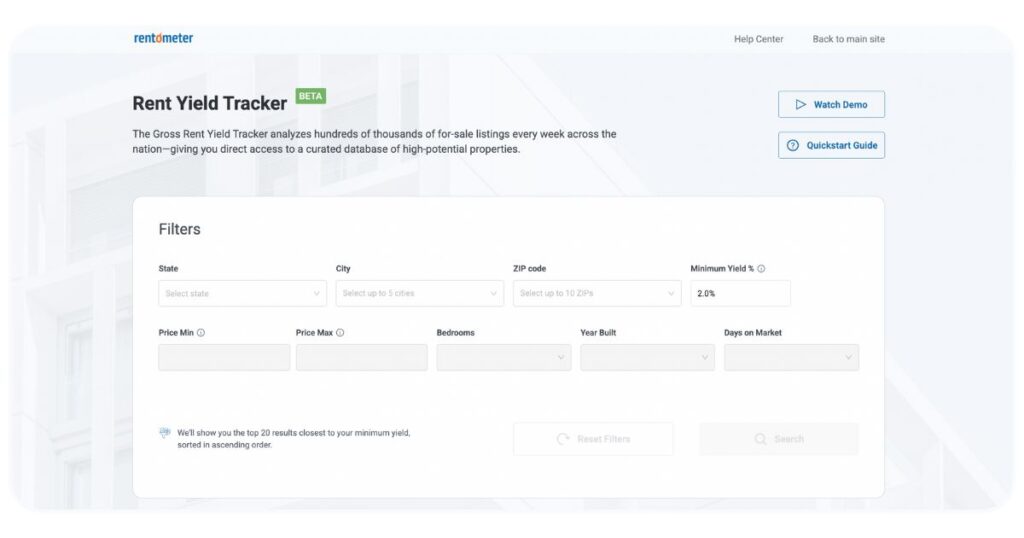

1. Rentometer’s Rent Yield Tracker

If you’ve ever spent days scrolling through Zillow or Realtor.com to find investment opportunities — and then hours in Excel calculating yields and ROIs — there’s now a better way.

Rentometer’s Rent Yield Tracker scans active for-sale listings nationwide and combines them with proprietary rent estimates to automatically calculate gross rent yields. You can filter by city, ZIP code, price range, bedroom count, and desired yield to zero in on the deals that meet your investment goals.

Stay connected

Get rental market insights delivered straight to your inbox.

Use it to instantly surface the strongest SFR opportunities in any city or ZIP code.

Want to try the Rent Yield Tracker? Get started for free today.

2. Marketplaces with MLS Listings

While Rentometer’s Rent Yield Tracker offers a more efficient way to scout great investment opportunities, there’s still value in using traditional marketplaces like Realtor.com or Zillow.

These platforms let you set up instant alerts for new listings or price drops on your favorite properties and include map-based search tools that let you visually explore neighborhoods, compare property locations, and spot proximity to key amenities or rental hotspots. Once you find a potential deal, use Rentometer’s Rent Estimate tool to calculate expected rental income and our ROI Calculator to assess the overall viability of the investment.

3. Build Relationships with Real Estate Agents

Sometimes the best opportunities never reach public listing sites. You’ve probably heard about Zillow’s ban on private listings and the ongoing controversy with Compass. Private listings also affect investment properties — and the only way to get them on your radar is to build strong relationships with local real estate agents.

Make a few calls, introduce yourself, and take the time to build real connections — invite agents for coffee or lunch to discuss the local market and what you’re looking for. Let them know your investment criteria, budget, preferred locations, and any red flags you want to avoid (e.g., certain neighborhoods or properties that require extensive renovations).

By partnering with local agents who specialize in investment properties, you can gain early access to “pocket listings” and pre-market deals. Strong agent relationships offer:

- Insider knowledge of emerging neighborhoods and undervalued areas

- Access to motivated sellers before listings go live

- Guidance on rental demand, tenant profiles, and renovation ROI

Investors who stay in regular contact with realtors often receive high-quality leads weeks before they appear online.

4. Commercial Marketplaces for CRE Investors

If you’re expanding into multifamily, mixed-use, or other commercial assets, platforms like LoopNet, Crexi, and CommercialCafe are invaluable.

They aggregate verified commercial listings and provide access to:

- Detailed property data (NOI, cap rate, tenant mix, lease terms)

- Broker contacts and offering memorandums

- Auction listings and off-market opportunities

These tools cater to both institutional and individual investors. With the right filters, you can uncover mid-sized multifamily or retail properties that generate strong, stable cash flow while diversifying your portfolio.There’s a saying in the industry that “the best deals never end up on LoopNet,” since brokers often shop them to trusted buyers before putting them online. That’s why it’s so important to build relationships with commercial brokers and large property owners (return to section 3 for more details) — whether you’re targeting single-family rentals, small multifamily units, or larger commercial properties.

5. Find Distressed and Off-Market Properties

Distressed assets — foreclosures, pre-foreclosures, and REOs — can offer deep discounts and strong upside potential. Here’s how to find them:

a. Pre-Foreclosures

Pre-foreclosures often deliver some of the highest returns on investment, as owners are motivated to sell. Since most of these properties haven’t yet hit the open market, competition with other investors is typically low.

Platforms like PropertyShark and RealtyTrac provide detailed pre-foreclosure listings along with valuable data for your research and due diligence — including ownership details, property characteristics, comps, tax & lien information, and foreclosure timelines. This allows you to contact owners before their properties reach auction — a powerful advantage for value-driven investors.

Note: Not every pre-foreclosure property is actively for sale, and owners in distress may not appreciate aggressive outreach. Approach these opportunities with tact and empathy — understanding that the sellers may be under significant financial or emotional stress.

b. Foreclosure Auctions and REOs

If a distressed owner doesn’t catch up on payments or sell during the pre-foreclosure stage, the property typically moves to auction. This stage can present a great opportunity to buy below market value, as lenders are often motivated to recover their losses and may accept bids under fair market price.

However, auction purchases carry higher risks — in most cases, you won’t be able to inspect the property beforehand, and the true extent of repairs or structural issues may be far greater than what’s visible from the outside. Buyers should always budget for potential renovation surprises and conduct thorough title research before bidding.

REO (Real Estate Owned) properties, on the other hand, are homes that didn’t sell at auction and have reverted to bank ownership. These are generally safer and more transparent purchases, since banks typically clear the title, handle outstanding liens, and allow buyers to tour and inspect the property before making an offer. While REOs may come at a slightly higher price than auction deals, they still offer significant discounts compared to market-rate listings — often with far less uncertainty.

6. Direct-to-Owner Mail Outreach

This time-tested strategy still works — reaching out directly to homeowners through postcards, letters, or neighborhood mailers can uncover hidden deals long before they hit the open market.

When guided by Rentometer neighborhood rent data, your outreach becomes even more strategic, letting you focus on high-demand and high-yield areas.

7. Driving for Dollars

This is a more targeted approach to the direct-to-owner mail outreach strategy described above.

Sometimes the best deals are found simply by driving through neighborhoods and spotting opportunities firsthand. If you’re a serious investor, you’ve probably done this countless times without even realizing it — walking or driving past a neglected property, wondering if it’s for sale, and already visualizing how you’d turn it around.

This method, known as “driving for dollars,” helps investors identify vacant, neglected, or under-maintained properties that may signal motivated sellers.

Take note of addresses, visible issues (like overgrown lawns or boarded windows), and location details. Then, cross-check those properties using public records or Rentometer’s neighborhood data to evaluate rent potential and ownership information.

A quick follow-up — whether through mail, a phone call, or a friendly knock — can turn an overlooked house into your next high-performing investment.

8. Wholesalers and Local Investor Networks

Wholesalers and real estate investment networks specialize in sourcing and vetting potential deals. By joining local REIAs, Facebook groups, or BiggerPockets forums, you can connect with other investors who often share off-market leads or investment opportunities.

These properties move quickly — so have your financing or proof of funds ready to act fast, but always take time to perform thorough due diligence.

9. Networking with Property Managers and Contractors

Property managers are often the first to know when landlords are thinking about selling — making them a valuable source of off-market opportunities. They have firsthand insight into which owners are struggling with vacancies, rising maintenance costs, or problem tenants — all strong indicators that a property might soon hit the market.

Likewise, contractors, inspectors, and maintenance professionals interact daily with local property owners and investors. A casual conversation with a trusted contractor can reveal which landlords are renovating units to sell, which investors are offloading underperforming assets, or which neighborhoods are seeing a surge in rehab activity.

Building relationships with these professionals — whether by attending local networking events, offering referral incentives, or simply staying in touch — can help you spot motivated sellers and hidden opportunities long before they appear online.

Final Thoughts

The most successful investors blend multiple approaches:

- Use Rentometer to target the best-yielding markets.

- Search residential and commercial MLS-based platforms for active listings.

- Build agent connections for early access.

- Explore distressed and off-market channels for deep-value plays.

Whether you focus on steady rental income or strategic flips, the key is combining data, relationships, and persistence.

One final note: while some of these strategies may seem straightforward, conducting proper due diligence or identifying a property’s true owner can be a challenging process. We’ll revisit this topic in a future article, where we’ll cover how to overcome these obstacles and uncover even more great deals.

Ready to find your next high-yield property?

Start with Rentometer’s Rent Yield Tracker and discover where your best opportunities lie.

Stay connected

Get rental market insights delivered straight to your inbox.

LinkedIn

LinkedIn

Facebook

Facebook

Email

Email

Twitter

Twitter

Quickly evaluate current rents with QuickView™ Rent Estimates

Quickly evaluate current rents with QuickView™ Rent Estimates