7 Ways to Find For-Sale Investment Properties

If you’re serious about growing your rental portfolio or scouting your next deal, the right property search tools can make all the difference. Between traditional real estate listing platforms and newer data-driven tools, property investors today have more ways than ever to uncover profitable rental opportunities.

Below are seven top-rated websites, tools, and strategies that can help you find—and evaluate—investment properties for sale.

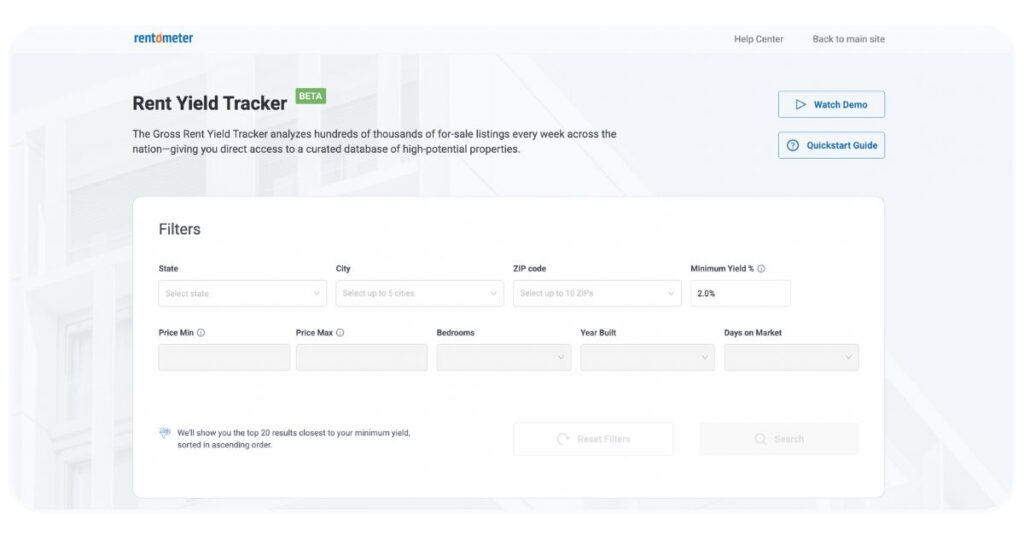

1. Rentometer’s Rent Yield Tracker

Best for: Data-driven investors targeting high-yield SFR

There’s a new tool in town for property investors looking to uncover the best SFR deals. If you’ve ever spent days scrolling through Zillow or Realtor.com to find single-family investment opportunities—and then hours in Excel calculating yields and ROIs—there’s now a much better way.

Stay connected

Get rental market insights delivered straight to your inbox.

Introducing Rentometer’s Rent Yield Tracker—a powerful new tool that scans active for-sale listings nationwide and combines them with Rentometer’s proprietary rent estimates to automatically calculate gross rent yields. The result: you get a curated list of properties for sale that match your desired gross yield, with filtering options for location, bedroom count, and more.

Want to see it in action? Check out our step-by-step guide.

2. LoopNet

Best for: Multifamily and commercial real estate investors

LoopNet is the go-to marketplace for investors looking beyond single-family homes. The site features the largest number of multifamily, office, retail, and mixed-use properties for sale across the U.S., with listings that often include tenant information, lease terms, and NOI (net operating income) projections.While LoopNet primarily caters to seasoned and institutional investors, it’s a powerful tool for anyone exploring the commercial or small-multifamily real estate sector.

3. Realtor.com

Best for: Investors looking for small 2–4 unit multifamily properties

If you’re in the market for small multifamily properties of up to four units, Realtor.com is a great place to start. The platform aggregates listings directly from MLS feeds nationwide, giving investors access to a wide range of opportunities in this segment.

With extensive filters, neighborhood data, and market insights, Realtor.com makes it easy to narrow your search and evaluate potential investments. For those focused on single-family rentals, Rentometer’s Yield Tracker offers a faster, data-driven way to source deals—while investors targeting larger multifamily or commercial properties should explore LoopNet or Crexi.

Pro tip: Check the “Property History” section to see how long a property has been on the market. If it’s been listed for an extended period, you may have room to make a more aggressive offer. Just be sure to do your due diligence, as a long time on the market can sometimes signal underlying issues such as property condition, location challenges, or pricing mismatches.

4. Crexi

Best for: Commercial and mixed-use investors seeking active deal flow

Crexi is a fast-growing online CRE marketplace that connects buyers, sellers, and brokers across all major commercial real estate asset classes—including retail, office, industrial, land, and multifamily. In addition to property listings, Crexi offers detailed financials, marketing packages, and even auction opportunities for off-market or time-sensitive deals.

It’s especially useful for investors who want real-time insights and nationwide exposure without the higher barriers and costs typical of institutional platforms.

5. Old-School Mail Outreach

Best for: Local investing and off-market opportunities

Not every great deal is found online. Some investors still successfully use direct-to-owner outreach, sending letters or postcards to homeowners in targeted neighborhoods. A short message expressing interest in buying can uncover off-market deals that never appear on MLS sites.

If you’ve identified a specific area or ZIP code where you’d like to invest, this grassroots approach can help you connect directly with motivated sellers—and get an early look at properties before they hit the market.

6. PropertyShark

Best for: Data-driven investors and professionals who value in-depth property research

PropertyShark stands out from other listing sites by offering both active property listings and foreclosure or pre-foreclosure opportunities, making it a powerful resource for investors searching for undervalued or distressed assets.

Beyond listings, PropertyShark provides comprehensive property data and ownership records, including title documents, zoning details, sales comps, assessed values, and even owner contact information. This level of detail allows investors to verify ownership, evaluate risk, and uncover off-market opportunities before making an offer.

While platforms like Crexi and LoopNet excel at showcasing commercial deals, PropertyShark is unmatched when it comes to due diligence and data depth, giving investors the insights they need to make well-informed, strategic investment decisions.

7. Auction.com

Best for: Investors seeking foreclosure, bank-owned, and distressed property deals

Auction.com is the largest online marketplace for foreclosure and bank-owned real estate, offering investors access to thousands of distressed residential and commercial properties nationwide. The platform specializes in auction-based sales, where buyers can bid online or in person, often acquiring properties at significant discounts compared to market value.

Each listing typically includes property details, auction dates, title information, and occupancy status, helping investors evaluate potential risks before placing a bid. While competition can be strong and some properties may require additional rehab or legal clearance, Auction.com remains one of the best platforms for finding below-market investment opportunities.

For investors comfortable navigating the foreclosure process, it’s a valuable tool to source high-potential deals and expand portfolios beyond traditional MLS listings.

What about Zillow, Trulia, or Homes.com?

If you’re looking for 2–4 unit properties, these platforms are all solid options — just like Realtor.com. However, since they all pull listings from the same MLS data sources, there’s really no advantage to using multiple sites. Stick with the one you find most intuitive or easy to navigate.For single-family rentals (SFRs), though, you’re much better off using Rentometer’s Yield Tracker, which goes beyond listings by showing real-time rent estimates and automatically calculating gross rental yields—helping you identify high-performing deals faster.

Final Thoughts

Finding the right investment property isn’t just about location—it’s about analyzing the numbers. Successful investors combine traditional listing sites like LoopNet and Realtor.com with analytics tools such as Rentometer to verify whether a deal truly pencils out.

If you’re ready to streamline your search and uncover high-yield properties quickly, check out our Rent Yield Tracker—your shortcut to smarter, faster, and more profitable rental investing.

Stay connected

Get rental market insights delivered straight to your inbox.

LinkedIn

LinkedIn

Facebook

Facebook

Email

Email

Twitter

Twitter

Quickly evaluate current rents with QuickView™ Rent Estimates

Quickly evaluate current rents with QuickView™ Rent Estimates